Great American finance has long been at the forefront of global economic development, with Wall Street serving as a symbol of financial prowess and innovation. From the early days of stock trading to the expansion of complex financial instruments, American finance has navigated through various challenges, adapting to new market conditions and regulatory changes. The resilience and adaptability of the American financial system have played a pivotal role in shaping global economic policies and practices.

One key aspect that sets American finance apart is its emphasis on capital markets, which provide a platform for raising funds through stocks and bonds. This dynamic environment allows companies to access capital for growth and expansion while offering investors opportunities to participate in wealth creation. Additionally, the presence of diverse financial institutions, ranging from traditional banks to investment firms, contributes to a robust ecosystem that fosters innovation and competition.

Furthermore, technological advancements continue to revolutionize American finance, with fintech disrupting traditional banking models and democratizing access to financial services. The rise of digital payment platforms, robo-advisors, and peer-to-peer lending demonstrates how technology is reshaping consumer behavior and challenging established industry norms. As American finance continues to evolve amidst an ever-changing landscape, it remains a driving force in shaping global economic progress while demonstrating resilience in the face of uncertainties.

Great American Finance: Navigating the Financial Landscape

The United States has long been synonymous with prosperity, innovation, and economic prowess, earning the title of the land of opportunity. From Wall Street to Silicon Valley, the Great American Finance landscape is a dynamic force that shapes global markets and drives technological advancements. As we delve into the intricacies of this multifaceted world, we uncover stories of triumph and adversity, resilience and risk-taking, and a relentless pursuit of financial excellence.

At the heart of Great American Finance lies a rich tapestry of individuals who have transformed their dreams into billion-dollar enterprises. From titans of industry such as Warren Buffett and Elon Musk to visionary entrepreneurs like Oprah Winfrey and Jeff Bezos, the saga of American finance is woven with tales of ambition, ingenuity, and sheer determination. But beyond the glitz and glamour are everyday Americans navigating complex financial systems with grit and tenacity. Join us on an exploration through this captivating realm where money never sleeps and opportunities abound.

1. The History of American Finance

The history of American finance is a tale of innovation, risk-taking, and resilience. From the establishment of the first bank in 1781 to the creation of Wall Street as a financial hub in the late 18th century, America has continually shaped and redefined global financial systems. The evolution from a primarily agrarian economy to an industrial powerhouse has been driven by visionary financiers and entrepreneurs who have capitalized on opportunities and navigated through economic upheavals.

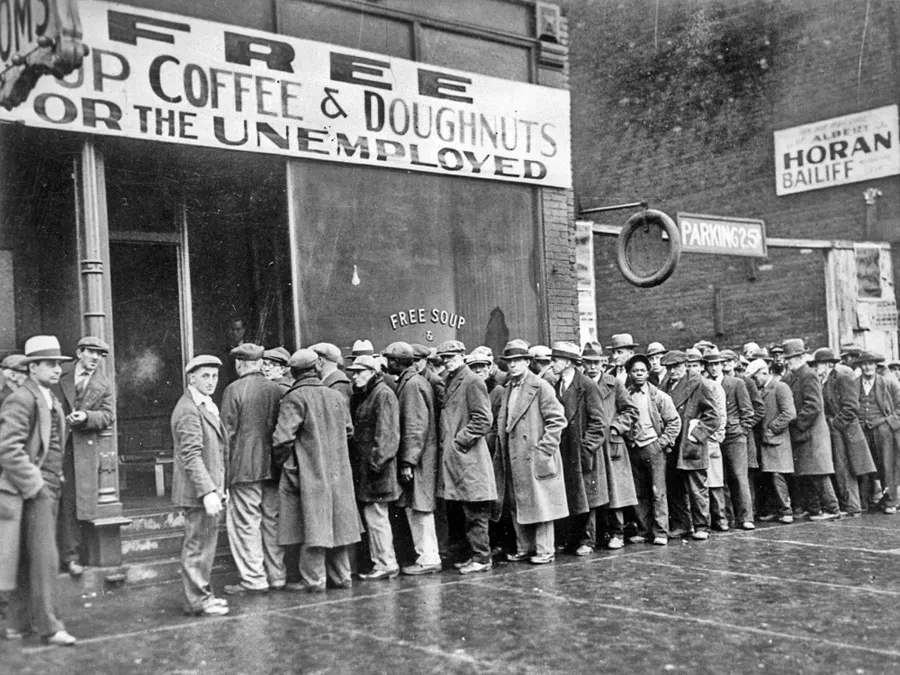

One pivotal moment was the founding of the New York Stock Exchange in 1792, which provided a platform for companies to raise capital and investors to participate in the burgeoning economy. Alongside this growth came periods of volatility, such as the Great Depression, leading to significant regulatory reforms like the Glass-Steagall Act which aimed to stabilize financial markets. As technology advanced, so did finance with the advent of electronic trading platforms and online banking, forever altering how individuals interact with their finances.

The American story of finance is one characterized by adaptability and perseverance. This ongoing narrative continues to shape not only domestic but also global economics as American financial institutions influence markets worldwide. Despite uncertainty and challenges throughout its history, American finance remains an emblematic force driving progress and prosperity.

2. Key Players in the American Financial System

The American financial system is a complex web of key players that drive the economy and shape the global financial landscape. At the forefront are large commercial banks such as JPMorgan Chase, Bank of America, and Wells Fargo, which play a fundamental role in providing essential banking services to consumers and businesses while also overseeing a vast network of branches and digital platforms. Another crucial player is the Federal Reserve, the central bank of the United States, which wields significant influence over monetary policy, interest rates, and overall economic stability.

In addition to traditional banks and regulatory bodies, investment firms like Goldman Sachs and Morgan Stanley are pivotal players in shaping financial markets through their expertise in asset management, trading strategies, M&A activities, and underwriting services. Furthermore, insurance companies such as Berkshire Hathaway and MetLife provide crucial protection for individuals and businesses against various risks while also investing billions in diverse asset classes. Together these key players form an intricate ecosystem that drives both domestic and international finance with profound implications for economic growth and stability.

3. Impact of American Finance on Global Economy

The impact of American finance on the global economy cannot be understated. With Wall Street serving as a hub for international finance, the decisions made in New York reverberate across the world. From the introduction of innovative financial products to setting benchmark interest rates, American finance plays a significant role in shaping global economic policies and trends. Moreover, the sheer size and influence of American financial institutions create ripple effects that can be felt in markets as far-reaching as Asia and Europe.

Additionally, American financial regulations and monetary policies have a profound impact on global economic stability. The 2008 financial crisis highlighted how interconnected the world’s economies had become through American financial instruments and institutions. This event spurred other countries to reevaluate their own regulations and oversight mechanisms to prevent similar crises from occurring within their borders. As a result, American finance continues to affect not only market dynamics but also broader economic governance worldwide.

4. Challenges and Opportunities in American Finance

The American finance industry is facing both challenges and opportunities in the current economic landscape. On one hand, the increasing complexity of financial regulations and compliance standards presents a significant challenge for financial institutions. Navigating through these regulations requires substantial investment in technology and human resources, posing a considerable hurdle for smaller firms.

Simultaneously, there are numerous exciting opportunities emerging within the American finance sector. The rise of fintech startups is revolutionizing traditional banking practices, providing innovative solutions to long-standing issues such as access to credit and efficient payment processing. Moreover, with the ongoing digital transformation, there is a growing demand for skilled professionals well-versed in data analytics and cybersecurity, creating new avenues for career growth within the finance industry. Through effective adaptation to regulatory changes and embracing technological advancements, American finance can overcome its challenges while capitalizing on its promising prospects.

5. Innovations and Trends in American Finance

The American finance industry is witnessing a remarkable shift towards digital innovation, as financial institutions embrace cutting-edge technologies to enhance customer experience and streamline operations. Fintech startups are driving this wave of change with disruptive solutions such as mobile payment platforms, robo-advisors, and peer-to-peer lending services. These innovations are not only reshaping traditional banking but also democratizing access to financial services for underserved communities.

Another key trend in American finance is the growing emphasis on sustainable and socially responsible investing. As awareness of environmental, social, and governance (ESG) factors continues to rise, investors are increasingly seeking opportunities that align with their values. This has led to an upsurge in ESG-focused investment products and the integration of sustainability metrics into the decision-making process of financial firms. As a result, companies are under more pressure than ever to demonstrate their commitment to ethical practices and environmental stewardship in order to attract capital.

In addition to technological advancements and sustainable investing, the rise of cryptocurrency and blockchain technology is also exerting a significant impact on the landscape of American finance. The widespread adoption of cryptocurrencies has challenged traditional banking systems by offering alternative means of value transfer and investment. Moreover, blockchain’s potential for secure record-keeping and automated smart contracts has garnered interest from various sectors within finance, paving the way for greater transparency and efficiency in transactions. As these trends continue to unfold, it’s clear that American finance is at the forefront of innovation, poised for further transformation in the years ahead.

6. The Future of American Finance

The future of American finance is poised for significant change as technology continues to revolutionize the industry. From blockchain and cryptocurrency to AI-powered financial management, advancements are reshaping how we invest, transact, and manage our money. With the rise of decentralized finance (DeFi), traditional banking models are being challenged, leading to greater democratization of financial services.

Furthermore, sustainable investing and environmental, social, and governance (ESG) considerations are gaining traction in American finance. Investors are increasingly prioritizing ethical and socially responsible investments, signaling a shift towards a more conscious approach to wealth management. As climate change and societal issues come to the forefront of global consciousness, these factors will significantly influence the direction of American finance in the years ahead. In conclusion, it’s clear that innovation and societal values will be critical drivers shaping the future landscape of American finance.

7. Conclusion: Embracing Change in American Finance

In conclusion, embracing change in American finance is crucial for its continued growth and relevance on the global stage. The landscape of finance is constantly evolving, with innovations such as cryptocurrency, digital banking, and AI-driven investment tools reshaping the industry. This presents both challenges and opportunities for traditional financial institutions to adapt and thrive in this ever-changing environment.

As we navigate through these changes, it’s important for American finance to maintain a balance between embracing innovation and upholding regulatory standards to ensure stability and security. Ultimately, by embracing change and leveraging technological advancements, American finance can cultivate a more efficient, transparent, and inclusive system that better serves the needs of diverse consumer groups. Embracing change in finance not only benefits the industry itself but also has ripple effects on economic growth, investment opportunities, and overall prosperity for individuals and businesses alike.

london finance

london finance