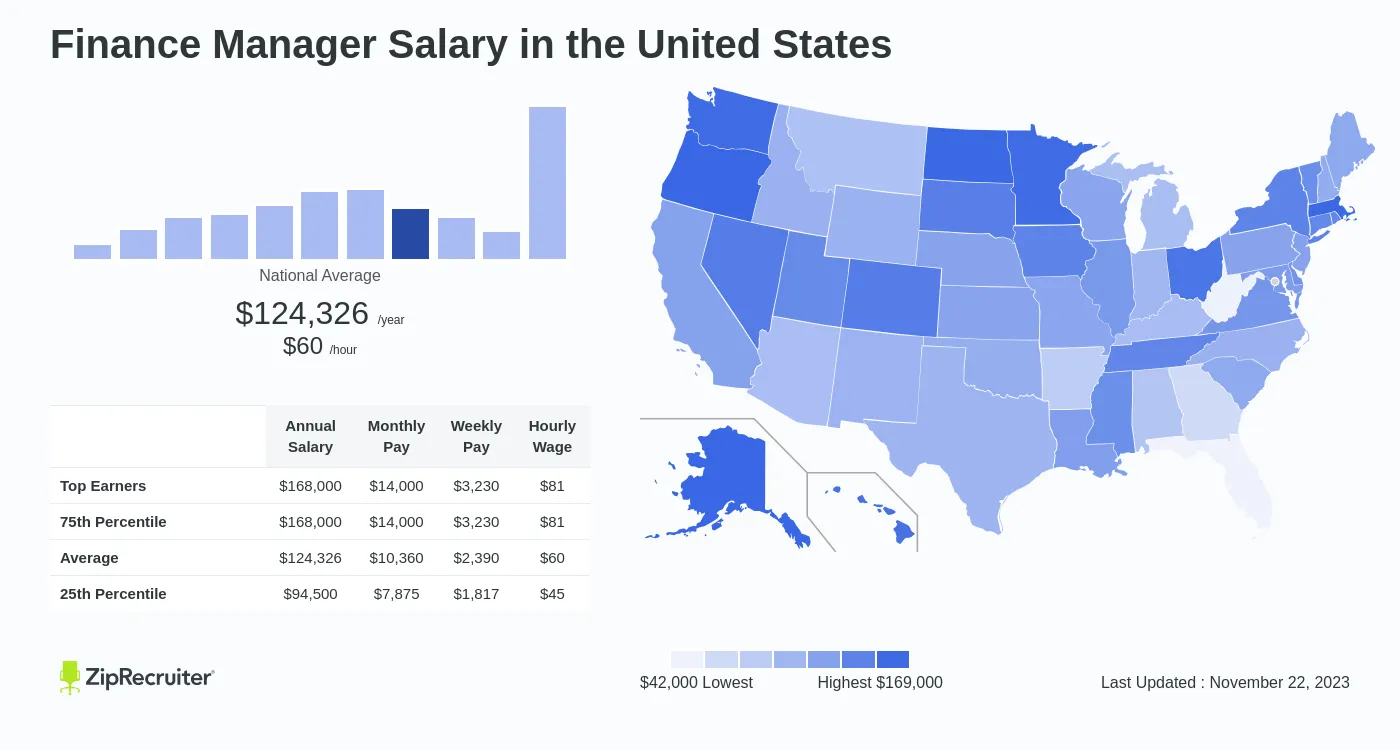

The role of a finance manager demands a high level of responsibility and expertise, which is often reflected in their salary. According to recent data, the average finance manager salary in the United States is around $120,000 per year. However, this figure can vary significantly based on factors such as location, industry, and experience. For instance, finance managers working in major financial hubs like New York City or San Francisco tend to earn higher salaries compared to those in smaller cities.

Moreover, the specific industry in which a finance manager works can greatly impact their earning potential. Those employed in sectors such as investment banking or private equity typically command higher salaries than those working in nonprofits or government agencies. Additionally, a finance manager’s level of experience and education also play crucial roles in determining their compensation package. Professionals with advanced degrees or professional certifications often secure higher-paying positions and have greater negotiating power when it comes to salary discussions. In essence, while an average figure provides a general idea of income expectations for finance managers, various nuanced elements contribute to variations within this broad spectrum.

Discover the Jaw-Dropping Salaries of Top Finance Managers!

Have you ever wondered just how much top finance managers earn? Prepare to be amazed. The salary range for top finance managers can leave you speechless, with some earning well into the seven-figure mark annually. As companies seek to navigate increasingly complex financial landscapes, the demand for exceptional talent in finance management has skyrocketed, leading to jaw-dropping compensation packages for those at the helm.

In addition to substantial base salaries, many top finance managers also enjoy lucrative bonuses and stock options as part of their overall compensation package. It’s no wonder that the allure of a career in finance management continues to grow, as professionals are drawn not only by the intellectual challenge of the role but also by the potential for truly life-changing financial rewards. With these eye-watering figures in mind, it’s clear that a career at the top of the finance ladder is not only mentally stimulating but also financially rewarding beyond measure.

The Shocking Truth About How Much Finance Managers Really Make

Finance managers are often seen as high earners, but the shocking truth is that their salaries can vary widely. While some finance managers bring in six-figure salaries, others may make significantly less, depending on factors such as location and industry. In fact, according to recent data, the average salary for finance managers hovers around $120,000 per year, with top performers earning upwards of $200,000 or more. However, it’s important to note that many finance managers also receive bonuses and other forms of compensation that can substantially boost their overall earnings.

What’s even more surprising is the disparity in pay between male and female finance managers. Despite efforts to close the gender pay gap, studies have shown that women in financial management roles still earn significantly less than their male counterparts. This unsettling revelation sheds light on the persistent inequalities within the finance industry and underscores the need for continued advocacy for gender equality in pay and opportunities. As we strive for greater transparency and fairness in compensation practices, it’s crucial to confront these disparities head-on and work towards creating a more equitable financial landscape for all professionals in this field.

Are You Being Paid Enough? The Average Finance Manager Salary Revealed

Are you being paid enough as a finance manager? This burning question often plagues professionals in the financial industry. The average salary for a finance manager is revealed to be $109,740 per year, according to recent data. However, it’s essential to consider various factors such as experience, location, and company size when evaluating whether this figure aligns with your worth.

Furthermore, emerging trends indicate that the demand for skilled finance managers is increasing. As companies navigate complex financial landscapes and seek strategic guidance for growth and stability, the role of finance managers becomes increasingly pivotal. With this heightened demand comes the opportunity for negotiation and higher compensation packages. It’s crucial for finance managers to stay updated on industry benchmarks and leverage their expertise to secure fair remuneration reflective of their invaluable contributions.

Stay tuned as we delve deeper into uncovering insights about the intricacies of finance manager salaries and provide actionable advice for navigating compensation discussions in our upcoming articles.

Unveiling the Eye-Popping Earnings of High-Flying Finance Managers!

As we delve into the realm of finance management, it’s impossible to ignore the eye-popping earnings that these high-flying professionals command. With an intricate understanding of financial markets, risk management, and investment strategies, finance managers play a critical role in guiding organizations toward profitability. It comes as no surprise then that their salary packages reflect the level of responsibility they shoulder.

In today’s competitive business landscape, finance managers are handsomely rewarded for their expertise and decision-making prowess. Their annual earnings often reach staggering figures, luring many talented individuals into this lucrative field. However, it’s essential to acknowledge that alongside these impressive numbers come intense pressure and long hours. Finance managers’ high-flying earnings also mirror the weighty expectations placed upon them to deliver astute financial insights and drive organizational success.

These substantial compensation packages serve as a testament to the pivotal role finance managers play in steering financial performance and strategic decision-making within companies. It’s clear that their ability to navigate economic uncertainties and capitalize on market opportunities places them at the forefront of driving corporate prosperity – a fact underscored by their enviable earning potential.

Think You’re Making Bank? Wait Until You See What Finance Managers Earn!

Finance managers are often seen as the masterminds behind a company’s financial success, and their salaries reflect that level of responsibility. With the increasing complexities of global finance and the growing demands on financial expertise, it’s no surprise that finance managers are reaping significant rewards. According to recent data, the average salary for a finance manager is well into six figures, with many earning bonuses and additional perks on top of that.

One striking aspect is how the earning potential for finance managers continues to rise even in uncertain economic times. This reveals not only the value placed on their skills but also the essential role they play in navigating financial challenges. In addition, with businesses constantly seeking to optimize their financial strategies and investments, finance managers have become indispensable assets who can command substantial compensation packages. It’s clear that these professionals not only make bank but also carve out financially rewarding careers in an ever-evolving industry.

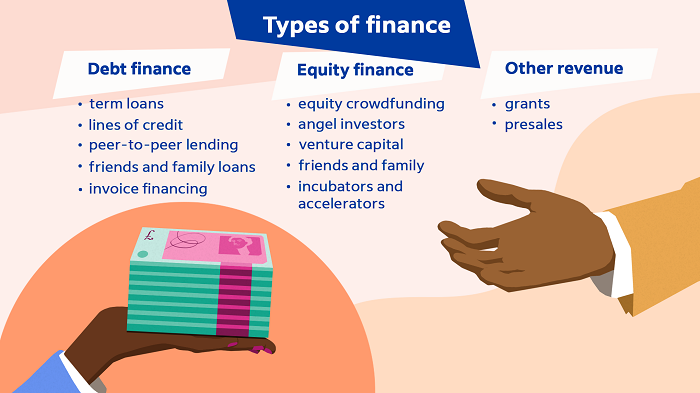

Exploring the Role of a Finance Manager

Exploring the role of a finance manager goes beyond just overseeing financial activities. This dynamic position requires a combination of strategic thinking, analytical skills, and the ability to guide the financial growth of an organization. A finance manager must possess strong leadership abilities to effectively manage teams and drive fiscal decisions that align with the company’s overarching objectives.

One key aspect often overlooked is the critical role finance managers play in navigating complex regulatory landscapes. They must stay abreast of evolving financial laws, compliance requirements, and industry standards to ensure the organization operates within legal boundaries while maximizing financial opportunities. Furthermore, their expertise in risk management enables them to identify potential threats and implement proactive measures to safeguard the company’s financial health.

In today’s rapidly changing business environment, finance managers also serve as valuable partners in driving innovation and adaptation. Their involvement in long-term strategic planning helps organizations capitalize on emerging trends, make sound investment decisions, and leverage resources efficiently. By embracing technological advancements and data-driven insights, finance managers empower businesses to thrive amidst uncertainty while creating sustainable value for stakeholders.

What Does a Finance Manager Do?

A finance manager plays a crucial role in guiding the financial decisions of an organization, overseeing the preparation of financial reports, and analyzing financial data to provide strategic insights. Beyond number crunching, they are key players in forecasting and budgeting, identifying areas for cost savings and revenue generation. Moreover, they play a pivotal role in risk management by ensuring compliance with regulations and developing strategies to mitigate financial risks. Their ability to interpret complex financial information into actionable plans makes them indispensable in driving overall business performance.

In today’s fast-paced business environment, finance managers are increasingly involved in leveraging technology to streamline processes and improve efficiency. They harness advanced tools such as data analytics to gain valuable insights that inform informed decision-making at all levels of an organization. With their finger on the pulse of economic trends and market conditions, finance managers also contribute to shaping long-term growth strategies and supporting diverse operational functions within an organization.

In essence, a finance manager is more than just a numbers person; they are strategic thinkers who bring together financial expertise with business acumen to drive sustainable growth while managing financial risks effectively.

Factors Affecting Finance Manager Salaries

Finance manager salaries are influenced by a multitude of factors, with experience often playing a significant role in determining compensation. Those with extensive industry knowledge and a proven track record of success can command higher salaries, as they bring valuable expertise to the table. Additionally, the size and complexity of the organization also impact finance manager salaries, as those working for larger corporations or multinational companies may be offered more competitive compensation packages due to the scale and scope of their responsibilities.

Educational background is another crucial factor affecting finance manager salaries. Individuals with advanced degrees such as an MBA or professional certifications like CFA or CPA often receive higher pay due to their specialized knowledge and skill set. Moreover, geographic location plays a pivotal role in salary discrepancies, as cost of living varies significantly across regions. Finance managers working in urban centers or high-cost areas typically command higher salaries than those working in more affordable locations, reflecting the differences in living expenses.

Average Salary Range for Finance Managers

Finance managers play a crucial role in organizations, overseeing the financial health and strategic planning. The average salary range for finance managers varies depending on factors such as experience, education, location, and industry. Generally, entry-level finance managers can expect to earn around $60,000 to $80,000 per year, while those with more experience or working in larger corporations can command salaries ranging from $100,000 to $150,000 annually.

However, it’s important to note that finance manager salaries can be significantly higher in certain industries such as investment banking or asset management. Additionally, geographical location also has a major impact on salary ranges for finance managers. For example, those working in major financial hubs like New York City or London may earn significantly more than their counterparts in smaller cities or rural areas. Understanding the various factors that contribute to the average salary range for finance managers is essential for professionals looking to enter this field or negotiate their compensation package.

In conclusion, finance manager salaries are influenced by a multitude of factors including experience level and industry specialization. As a result, individuals considering a career as a finance manager should carefully research the market trends and demands of different sectors to gain an accurate understanding of potential earnings. By staying informed about these influences on salary ranges within the field of financial management will ensure that professionals are better positioned to achieve their desired levels of compensation and career growth within this dynamic field.

Regional Variations in Finance Manager Salaries

The salary of a finance manager can vary significantly depending on the region in which they work. For example, finance managers in major metropolitan areas such as New York City or San Francisco tend to command higher salaries due to the high cost of living and increased demand for financial expertise. On the other hand, finance managers working in smaller cities or rural areas may receive lower salaries due to lower living costs and less competition for skilled professionals.

Additionally, regional economic factors play a critical role in determining finance manager salaries. In regions with strong financial sectors and robust economies, finance managers are likely to earn higher salaries compared to those working in areas with less economic activity. Factors such as local industry specialization, cost of living adjustments, and overall business climate also contribute to the regional variations in finance manager salaries. Understanding these regional disparities is crucial for both employers and job seekers when negotiating compensation packages and making career decisions within the finance industry.

Skills and Experience Impacting Salary Potential

When it comes to finance manager salaries, the impact of skills and experience cannot be overstated. Those with in-demand skills such as financial analysis, strategic planning, and risk management often command higher salaries due to their ability to drive business growth and profitability. Experience also plays a crucial role, as finance managers with a proven track record of successfully managing complex financial portfolios or leading high-stakes projects are seen as valuable assets to an organization.

Moreover, specialized skills like knowledge of international finance regulations or proficiency in data analytics can set finance managers apart in the job market and lead to higher earning potential. As businesses continue to navigate through economic uncertainties and technological advancements, the demand for finance professionals who possess these specialized skills will likely increase, further impacting salary potential. In essence, the combination of relevant skills and extensive experience creates a compelling case for employers to offer competitive compensation packages to top-tier finance managers who can drive results and contribute significantly to company success.

Conclusion: Understanding the Financial Rewards of Management

In conclusion, understanding the financial rewards of management goes beyond just a paycheck. While a finance manager’s salary can be substantial, it is important to also consider the various non-monetary benefits that come with the role. These can include performance bonuses, stock options, and other incentives that can significantly enhance the overall compensation package.

Furthermore, the long-term financial prospects of management positions should not be overlooked. With potential for career growth into higher executive roles and increased responsibilities comes greater earning potential and influence within an organization. This underscores the importance of acquiring strong managerial skills and staying abreast of industry trends to maximize one’s financial rewards in this field.

FAQ

1. What is the average salary of a finance manager?

– The average salary of a finance manager ranges from $70,000 to $120,000 per year, depending on location and experience.

2. What factors influence a finance manager’s salary?

– Factors such as education level, years of experience, industry, company size, and geographic location can all impact a finance manager’s salary.

3. Do finance managers receive bonuses or other incentives?

– Yes, many finance managers receive bonuses, profit sharing, and other incentives as part of their compensation package.

4. Is there room for salary growth in the field of finance management?

– Yes, with continued education and increasing levels of responsibility, finance managers can expect steady salary growth throughout their careers.

5. Are there differences in salaries for finance managers in different industries?

– Yes, salaries can vary significantly based on the industry in which a finance manager works. For example, those in the healthcare or technology sectors may earn higher salaries than those in nonprofit organizations.

6. What are the highest-paying locations for finance managers?

– Major metropolitan areas such as New York City, San Francisco, and Chicago tend to offer some of the highest salaries for finance managers due to the high cost of living and demand for skilled professionals.

7. Can entry-level candidates expect competitive salaries as finance managers?

– Entry-level candidates may start with lower salaries but can expect competitive compensation as they gain experience and demonstrate their value to employers.

8. Are there additional perks or benefits that come with being a finance manager?

– In addition to competitive salaries, many companies offer perks such as stock options, retirement plans, health insurance benefits, and flexible work arrangements to attract and retain top talent in the field of financial management.

london finance

london finance